SINCE 2011

PROP FIRM EA. AKRON, OHIO SINCE 2011

We will make you PASS prop firm challenges and get Funded up to $10M in Trading Capital, we are a group of private traders with 14+ Years of consistency in the financial markets. Throughout this period we have been able to help thousands of struggling traders to make money profitably through the crucial Knowledge we impart and signals we provide. This time, we are delighted to publicly announce that our only mission is to make sure that every trader who is struggling with low capital gets FUNDED and makes consistent income in the long run.

Pricing

Prop Firm EA Price

*We only take a few spots per month to avoid prop firm maximum capital allocation for EA! 30 Days Risk Free Guarantee!

Personal

- Monthly fee

- $5k – $199k

- One account license

- 15% commission on payouts

- 8% – 16% monthly

- 2% max daily dd

- 10% max dd

- Customised set file per client

- 1,572+ clients funded

- 96.8% challenge pass rate

- 24/7 Support

- 30 days risk free guarantee

Deluxe

- Monthly fee

- $200k – $1M

- One account license

- 15% commission on payouts

- 8% – 16% monthly

- 2% max daily dd

- 10% max dd

- Customised set file per client

- 1,572+ clients funded

- 96.8% challenge pass rate

- 24/7 Support

- 30 days risk free guarantee

Pro

- One time fee

- $5k – $1M

- Unlimited license

- 0% commission on payouts

- 8% – 16% monthly

- 2% max daily dd

- 10% max dd

- Customised set file per client

- 1,572+ clients funded

- 96.8% challenge pass rate

- 24/7 Support

- 30 days risk free guarantee

Enterprise

- MQ4 & MQ5 source code file

- 24/7 Support

- 30 days risk free guarantee

Having problem with payment?

Pass your prop firm challenge with our prop firm EA. Enjoy consistent and passive profits every single day from only $50 per month.

OUR HIGHEST EARNING TRADER: HOLLY DISCUSSES HER JOURNEY WITH FTMO | OVER $1.6M TOTAL WITHDRAWALS

When Holly first came to us, she had already failed 2 prop firm evaluations on her own. She was discouraged, frustrated, and considering quitting trading altogether. After a consultation, we assigned her account to one of our senior traders. Within 24 trading days, the challenge was passed and her verification completed. Over the next year, Holly steadily grew her funded account, withdrawing over $1.6 million in profits. Her story is proof that with the right support, discipline, and strategy, even a struggling trader can turn into a consistent, highly successful professional.

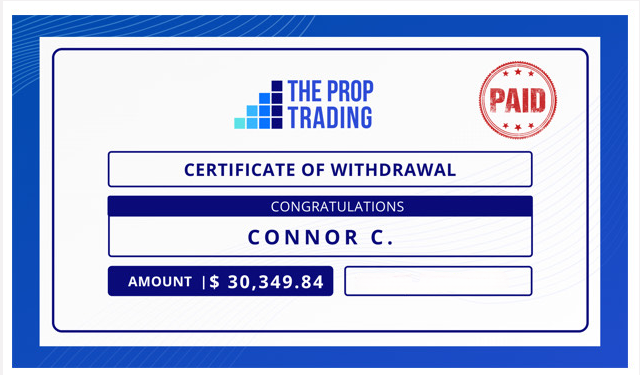

OUR HIGHEST SINGLE WITHDRAWAL: CONNOR SHARES HER $30K WITHDRAWAL EXPERIENCE ON QUORA | OVER $350K TOTAL WITHDRAWALS

Connor never struggled with spotting good trades, her real challenge was discipline. She had the skill but often pushed too hard, chasing results and ignoring firm rules. That changed when she partnered with our team. We gave her structure, strict risk management, and a clear path to follow.

Her first major payout came quickly: a $30,349.84 withdrawal that completely shifted her outlook on trading. From there, she focused on steady growth rather than fast wins. The result was more than $350,000 in total withdrawals and a career built on patience and consistency instead of pressure.

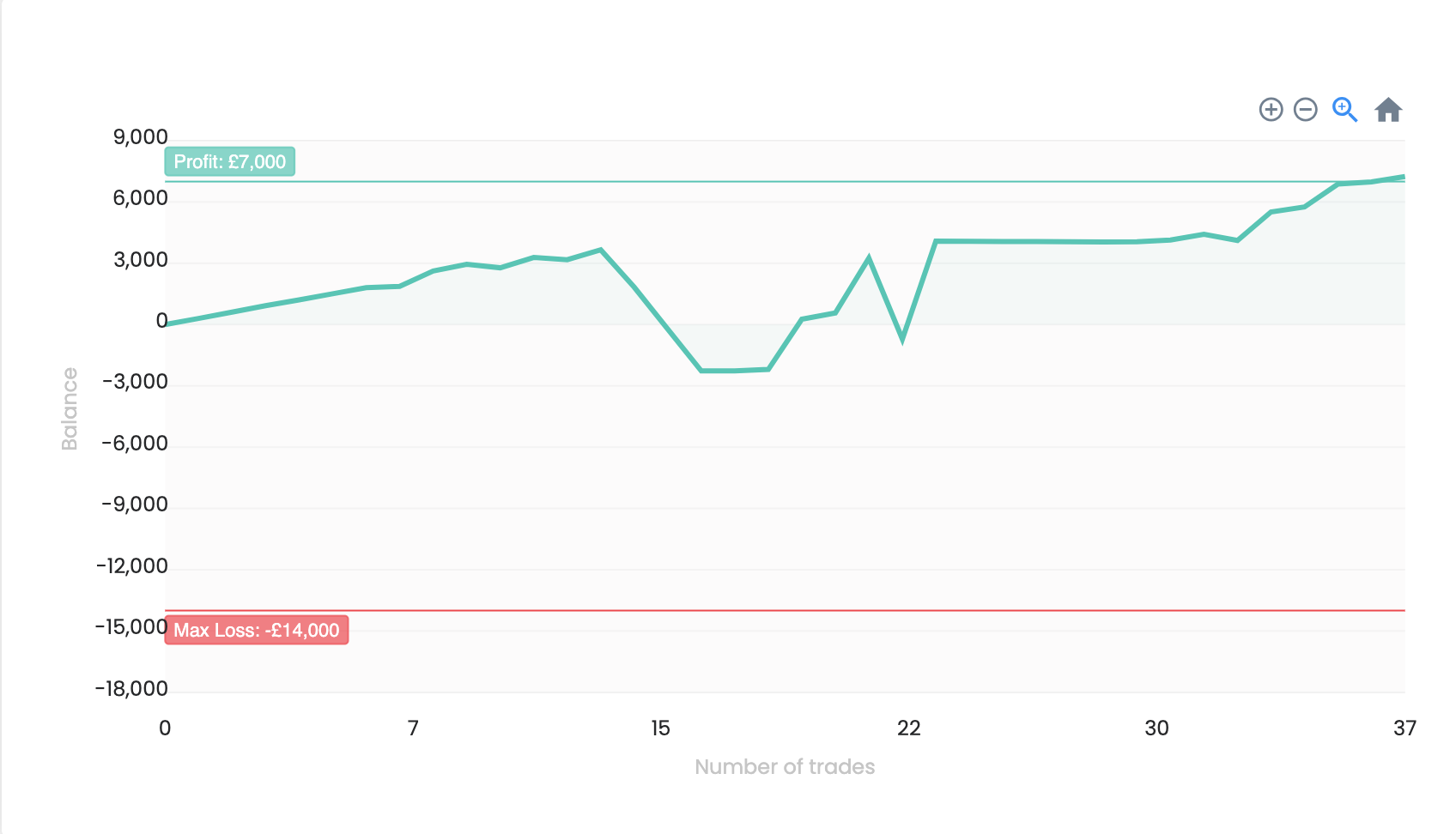

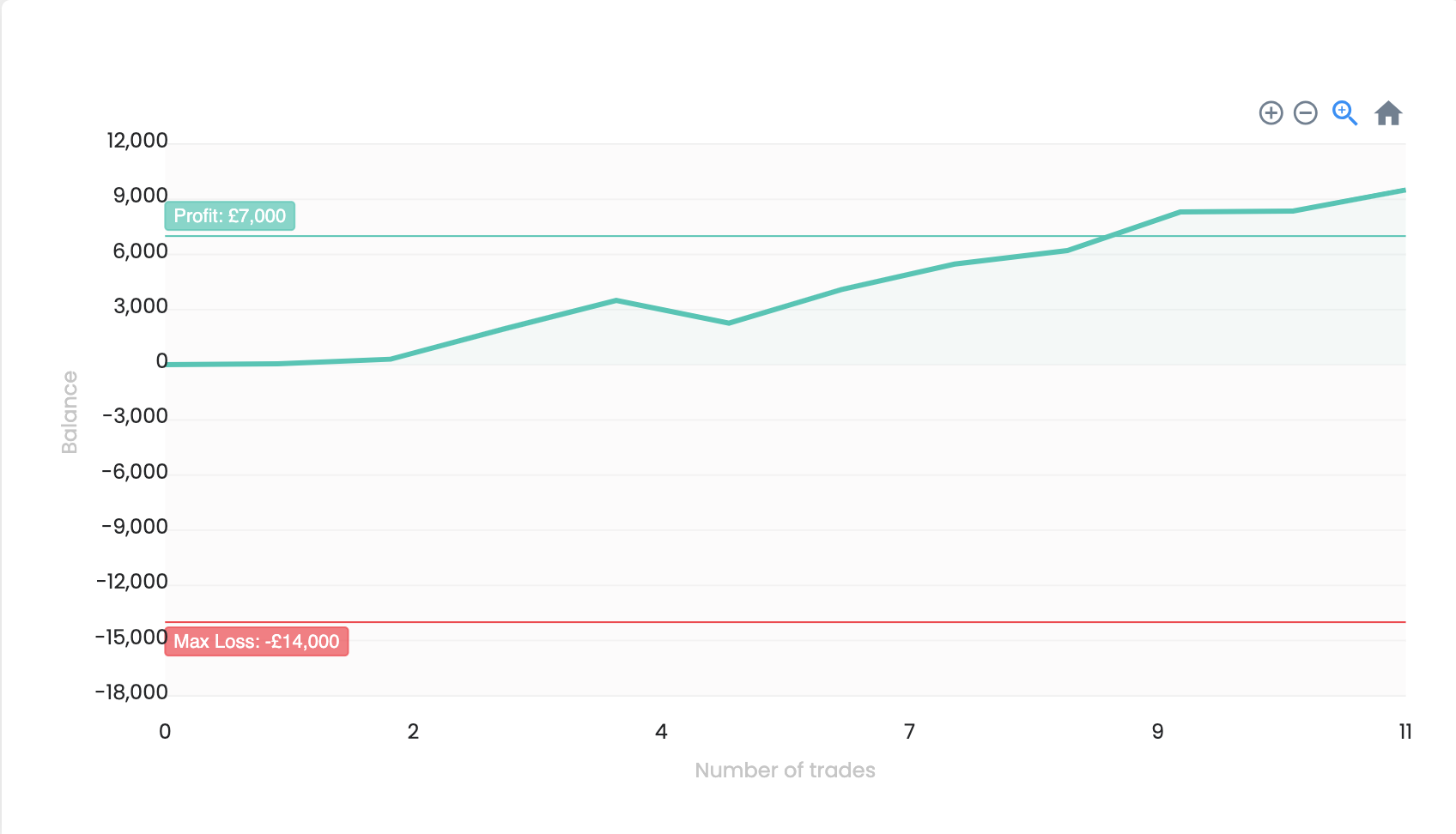

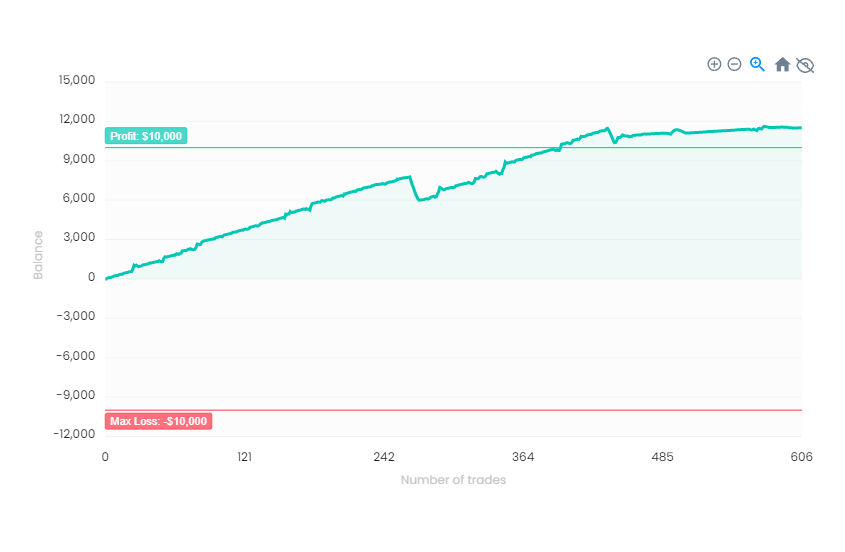

HOW OUR EA WORKS

Our prop firm EA is not just another trading robot. It was built from the ground up to solve one specific problem: helping traders pass evaluations and stay consistently profitable once funded. Instead of gambling or using dangerous strategies, it combines discipline, automation, and adaptability to outsmart the strict rules that make most traders fail.

Risk management

The software calculates the correct lot size for each trade relative to your account balance and prop firm limits. It never risks more than allowed.

Adaptability

The prop firm robot is updated regularly. Markets change, and rules change. We release new set files and upgrades to keep everything sharp.

Platform compatibility

You can run the prop firm ea mt5 or mt4 version. Both are tested and optimized.

Scalability

Whether you start with a $5k challenge or a $1M funded account, the same engine powers your growth. The ea for prop firm accounts is designed to scale with you.

Momentum recognition and risk-based sizing

The EA is programmed to detect when the market is trending strongly and to enter trades that ride that momentum. When conditions are choppy or flat, it automatically reduces risk or pauses entries to avoid unnecessary losses

News event protection

High-impact news can wipe out an account in seconds. Our EA includes filters that detect economic events and either pause trading or reduce exposure. This way you avoid sudden spikes during NFP, CPI, or central bank meetings.

Spread and slippage control

Not all brokers have the same trading conditions. The EA constantly checks spreads and slippage before executing trades. If spreads are too high, it waits. If slippage is abnormal, it adjusts. This ensures every entry and exit is safe, no matter which prop firm broker you are using.

Time-based trading filters

The system allows you to limit trading to specific hours when liquidity is highest, such as London and New York sessions. By avoiding quiet hours or rollover periods, the EA focuses only on high-probability trading windows.

Regular performance updates

We do not believe in “set and forget forever.” Our development team constantly refines the logic, improves entries, and adjusts risk control based on market feedback. This ensures you are always running the best ea for prop firm accounts, not a stale version that stopped working years ago.

Equity protector

The EA comes with a built-in equity protector that monitors your account balance in real time. If performance ever deviates from safe levels, the system cuts off trading automatically. This feature protects your evaluation fee and keeps you in the game.

Multi-asset support

While many bots only work on EURUSD, our EA trades forex pairs, gold, and even indices like NAS100 and US30. This variety spreads risk and opens more opportunities to hit profit targets without overexposing on one instrument.

VPS-friendly design

Since most prop firms require stable connectivity, the EA is designed to run smoothly on low-latency VPS setups. You do not need a high-end computer to keep it working. As long as you have a basic VPS or stable internet, it performs without interruptions.

STEP BY STEP GUIDE: HOW TO START WITH OUR EA

Our EA uses a blend of momentum recognition and risk-based sizing. It identifies entry points during trending phases and reduces exposure during sideways markets. Built-in filters avoid trading during extremely high spreads or news events.

Step 1. Choose the right plan

Decide which license matches your goals. If you are just starting out, the personal license is perfect for a single challenge account. If you are ready to scale, the deluxe and pro licenses give you more flexibility and more room for growth.

Step 2. Install MetaTrader

Download either MetaTrader 4 or MetaTrader 5 from your prop firm’s broker. Both platforms work well with our system, though the prop firm ea mt5 version is slightly faster in execution and testing.

Step 3. Attach the EA

Once MetaTrader is ready, attach the EA to your chosen chart. You only need to do this once. The setup is quick, and we provide detailed instructions to make sure nothing is missed.

Step 4. Load the set file

Each prop firm has different rules for maximum drawdown and daily loss. To make sure you stay compliant, we provide customized set files. Simply load the one that matches your account size and firm. This way the ea for prop firms respects every limit automatically.

Step 5. Run the EA

After setup, let the bot trade. Monitor performance in the first few days just to see it in action, then relax and allow the automation to take over. This is where the benefit of a prop firm robot becomes obvious. You save time and energy while still moving toward your funding goals.

Step 6. Scale up after funding

Once you pass the evaluation, keep using the EA on your funded account. Many clients run it on multiple funded accounts at once. That is how they build large portfolios of capital while risking nothing of their own.

90% OF TRADERS FAIL THE CHALLENGE

According to FTMO and similar firms, only about 10 percent of traders actually pass their challenges. That means 9 out of every 10 people who pay the entry fee end up losing their money and never see the funded account. The failure rate is so high because the evaluation rules are designed to expose weaknesses. You have to make profit while staying inside strict daily loss and maximum drawdown limits, and even experienced traders slip up. Add to that the psychological stress of trading under pressure, and it becomes clear why the odds are stacked against most people.

We understand how frustrating it feels to invest in challenge after challenge and end up with nothing to show for it. That is exactly why we developed our prop firm ea, a fully automated trading system built specifically to handle evaluations. Instead of relying on emotion, luck, or inconsistent manual strategies, the EA follows precise rules and risk parameters that keep you safe from violations. Every trade is calculated to align with the prop firm’s conditions, which means you no longer need to stress about hitting the daily loss limit or overleveraging your account.

This ea to pass prop firm challenge was designed for consistency. It does not try to gamble or chase unrealistic profits. Instead, it works steadily toward the target, adapting to market conditions and protecting your account at every step. That is why so many traders who failed multiple times on their own have finally secured funding using our system.

Once you purchase the EA, you are not limited to a single attempt. You can run the bot on as many challenges as you want until you succeed. And after you get funded, the automation keeps working for you on the funded account itself. That means you can enjoy real passive income while focusing on scaling your portfolio, instead of stressing about rules and violations.

In short, while most traders continue to fail, you do not have to be one of them. With the best prop firm ea designed to pass evaluations and keep trading profitably after funding, you can finally move from endless challenge attempts to consistent payouts and long-term growth.

WHY CHOOSE US

10X Your Profit Splits With Our Personalized prop Farming Model

Prop Farming Blueprint is the exact blueprint for how anyone can make money “Prop Farming” without risking any of your own capital.

PROP FIRM EA MILESTONES

Customised set file per client

500+ Clients Funded

96.8% Challenge Pass Rate

Unlimited Accounts License

30 Days Risk free Guarantee

OUTSMART THE TRADING FIRMS

Tired of failing prop firm challenges? You are not alone. The truth is that more than 90 percent of traders do not make it through the evaluation phase because the rules are strict and the emotional pressure is high. One bad trading day can easily wipe out weeks of effort and cause you to lose your entry fee. That is why we built our prop firm ea trading bot, to give you a smarter, safer, and fully automated way of beating the firms at their own game.

Our EA is designed to respect every rule that matters. It calculates trades with discipline, manages risk with precision, and never lets emotions take control. Instead of guessing when to buy or sell, the EA waits for the right market conditions and executes trades that keep you well within daily and overall drawdown limits. This means you will never again have to worry about waking up to find your account breached or a violation notice in your email.

With hundreds of traders already funded through our system, the results speak for themselves. Whether you are new to trading or have failed multiple challenges before, our EA gives you a fair chance to finally succeed. It does not matter if your target is a $10k account or a $1M funded portfolio, the automation adapts to any account size and any firm’s rules. This is why so many of our clients call it the best prop firm ea they have ever used.

We keep access limited to only a few spots each month in order to protect performance and avoid saturation across firms. By keeping the community exclusive, we maintain the consistency that makes passing challenges realistic. And because we are confident in what the EA delivers, you are covered with a full 30-day risk free guarantee. If you follow the instructions and still do not see results, you get your money back, no questions asked.

Outsmarting the trading firms is no longer about luck or long nights staring at charts. It is about putting proven technology on your side and letting it do the heavy lifting for you.

Our results aren’t just numbers, they’re real proves

$100M+

Funded with our EA

$3.5M

Startup capital raised

8% to 16%

Average monthly returns

FAQ

How can i contact you?

We’re always here to assist you! You can reach us 24/7 via Telegram by sending us a message at our dedicated support channel. Our average response time is around 5 minutes, ensuring that we address your queries promptly and efficiently. We make it easy for you to get the help you need, whenever you need it.

Is your prop firm ea allowed by prop firms?

Yes, our prop firm EA is completely compliant with the guidelines of most prop firms. These firms allow the use of EAs (Expert Advisors) as long as they are configured to meet the specific rules and risk limits of the evaluation. It’s always a good idea to double-check the specific terms of any prop firm before starting the challenge, but rest assured, our EA follows all required guidelines.

How long does it take to pass the challenge?

The time it takes to pass a challenge depends on several factors, primarily the risk settings you choose for the EA. When you purchase the EA, you will receive a detailed guide with the optimal risk parameters for different account sizes. By using these settings, you will ensure that the trading meets the prop firm’s requirements and objectives. On average, with the correct settings, most users pass the challenge within the given timeframe. However, it’s important to monitor your progress and adjust the parameters if necessary to ensure success without taking unnecessary risks.

Can I use your prop firm EA on funded accounts?

Absolutely! You can continue using our EA on both Challenge and Funded accounts without any restrictions. Once you’ve passed the evaluation and become funded, you can seamlessly transition to using the EA for ongoing live trading. The EA is designed to optimize trading performance, whether you’re still in the evaluation phase or managing a funded account. This allows you to maintain consistency and efficiency with automated trading without worrying about account limitations.

Why choose a prop firm EA instead of a passing service?

Passing services that involve third-party traders are not only risky but also violate prop firm policies. Sharing your login details with another person to have them trade on your behalf can lead to account termination, as it goes against the prop firm’s rules. With our EA, you don’t have to worry about any of that. EAs are fully allowed by almost all prop firms and provide a fully automated, risk-free way of passing the challenge. You retain control of your account, and there is no need to share sensitive login details with anyone else.

What account sizes can I use it on?

Our prop firm EA is versatile and can be used on accounts of all sizes. Whether you’re starting with a small challenge or working with a larger funded account, the EA is adjustable to meet the specific requirements of any account. We provide you with the flexibility to scale your settings based on your account size, ensuring that you can pass the challenge and maintain consistent performance on both small and large trading accounts.

Can I use your EA on funded accounts?

Yes, you can! The EA is fully functional on both challenge accounts and funded accounts. In fact, once you pass the evaluation and secure funding, the EA can help you maintain a disciplined, profitable trading strategy. There’s no need to switch off or reconfigure your approach once you’ve reached this stage. The EA is designed to adapt seamlessly across all phases of your trading journey, from challenge to funded status, ensuring you keep the momentum going.

What is the best way to configure my EA for maximum success with prop firm evaluations?

Configuring your EA correctly is crucial for success. Start by ensuring that it is set to meet the specific requirements of the prop firm’s evaluation rules. Tailor the risk management settings, such as drawdown limits and trade sizes, to suit the parameters of the challenge. Monitoring the EA’s performance regularly, especially during the early stages, will help in adjusting settings for optimal results.

Can I use the EA on any trading platform?

The EA is typically designed for platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), as these are the most widely accepted by prop firms. Before getting started, ensure that your chosen platform is compatible with the EA and the prop firm’s rules. It’s also essential to verify that the platform allows automated trading and that you can use the EA without breaching any terms of service. If you’re using a less common platform, contact the EA provider for compatibility details.

Can the EA handle news events or high-volatility periods?

Yes, our EA is built with adaptive risk protocols that recognize and respond to volatile market conditions, including major news releases. You can configure it to reduce trade size, pause trading, or implement tighter risk controls during high-impact economic events. This flexibility helps preserve your account’s stability and ensures compliance with prop firm risk parameters, even in fast-moving markets.

Is there a recommended internet or VPS setup for running the EA smoothly?

To ensure optimal performance and avoid connectivity issues, we recommend using a reliable VPS (Virtual Private Server) with low latency and consistent uptime. Many prop firm traders use dedicated Forex VPS providers that support MetaTrader 4 and 5. A stable internet connection is essential for avoiding trade execution delays or errors that could negatively affect your evaluation results.

How often is the EA updated to reflect market changes or prop firm rule updates?

Our EA is regularly maintained and updated to adapt to evolving market conditions and the latest prop firm requirements. We closely monitor feedback from our users and changes in trading environments, pushing out performance and compliance updates as needed. When updates are available, you’ll receive clear instructions to implement them with minimal downtime, keeping your strategy sharp and compliant.

What makes your prop firm EA different from other trading bots?

Most trading bots in the market are either generic scalpers, martingale systems, or grid traders that ignore the strict rules of prop firms. Our prop firm expert advisor is specifically designed with these restrictions in mind. For example, it respects daily drawdown rules, overall drawdown limits, and maintains consistent risk-per-trade allocation. Unlike most bots that try to maximize short-term gains, our EA is built for longevity, it aims to safely pass challenges and then continue trading profitably on funded accounts. Think of it as a specialized EA to pass prop firm challenge, rather than a random robot meant for retail accounts.

How secure is it to use your EA with my prop firm account?

Security is a top priority. You never share login credentials with us, you simply install the EA directly on your account via MetaTrader 4 or 5. All configurations are in your control, and we provide encrypted set files to ensure performance without exposing strategies. Compared to passing services, where someone else trades your account and may get it banned, using a prop firm EA is far safer because you remain the only account owner. Additionally, since the EA follows firm rules, the chances of account flagging are virtually zero.

Does your EA work for multiple prop firms or just one?

Our prop firm passing EA is compatible with nearly all major firms including FTMO, Fundednext, The Funded Trader, The 5%ers, E8, SurgeTrader, and more. Each firm has slightly different rules (e.g., max daily loss, trailing drawdown, profit targets), but our software comes with optimized set files for each of them. That means you don’t have to worry about manually figuring out the risk rules — you can simply load the correct settings and trade. This flexibility is one of the reasons users call it the best prop firm EA available.

Can I run the EA on more than one account at the same time?

Yes, depending on your license. The Personal and Deluxe licenses allow one active account at a time, while the Pro license allows unlimited accounts. Many of our clients prefer to run the EA simultaneously on multiple funded accounts to maximize payouts. For example, if you have 3 x $100k accounts, the EA can trade all three in parallel, effectively giving you a $300k combined exposure. This scaling potential is what makes prop EA solutions so powerful.

Do I need previous trading knowledge to use your prop firm EA?

Not at all. The EA is designed for both beginner and advanced traders. If you’re new, you simply install MetaTrader, attach the EA, and load the provided set file. That’s all, it will trade automatically for you. If you’re more experienced, you can fine-tune risk parameters, trading hours, and pair selection. We also include a detailed user manual and provide live support to ensure you set everything up correctly. In short, even if you have never placed a trade manually, you can still use our ea prop firm solution successfully.

How do I know the EA will not blow my account?

Unlike high-risk systems that promise “quick flips,” our EA is built around strict money management. It uses fixed fractional risk, built-in equity protectors, and automatic trade filters to avoid overexposure. It will never open oversized trades that could wipe your account in one move. Even during volatile events, the EA can be configured to pause or reduce trade size. This risk management structure is the backbone of passing challenges and why so many traders succeed with this prop firm expert advisor where others fail.

What pairs and timeframes does your EA trade?

Our EA works on multiple forex pairs, indices, and even some commodities. By default, the best performance comes from EURUSD, GBPUSD, and XAUUSD on the M15 and H1 timeframes. However, we provide optimized set files that include other pairs like USDJPY, US30, and NAS100 for those who want more diversity. The flexibility allows you to scale depending on the firm’s leverage and spreads. This adaptability is one of the reasons traders refer to it as the best prop firm ea across different brokers.

How is this EA updated to keep up with changing markets?

Markets evolve constantly, spreads widen, volatility shifts, and prop firms update rules. That’s why our EA is actively maintained. We release updates every few months with improved algorithms, new safety filters, and adjusted settings for the current trading climate. For example, if a firm suddenly changes its maximum daily drawdown rule, we issue a new set file that ensures compliance. This commitment to maintenance is what separates a quality prop firm passing EA from abandoned robots that eventually fail.

Will the EA work if I only have a small challenge account?

Yes. Our clients range from $5k challenges to $1M funded accounts. Smaller accounts are actually easier for the EA since the profit target is lower and rules are less strict. The same engine that passes $200k accounts will work for $10k accounts, only scaled down. This means even beginners with limited capital can benefit from automation. Whether you’re going small or aiming for a portfolio of big accounts, this prop EA adapts accordingly.

What if I don’t achieve the target within the prop firm’s time limit?

While most users succeed within the given timeframe, challenges sometimes depend on market conditions. If the market is unusually flat, the EA may take longer to hit profit targets. In that case, the solution is adjusting settings to allow slightly higher risk exposure while staying within safe limits. Our support team helps you tweak these parameters so you maximize the chances of completing within the deadline. Even if it takes slightly longer, the key is avoiding violations, better to pass late than blow the account.

Can I stop the EA and trade manually on the same account?

Yes, you can. The EA does not lock your account; you can intervene manually whenever you want. However, we recommend avoiding interference unless you understand the strategy, because manual trades can distort the EA’s risk control. For example, if the EA is carefully balancing exposure and you manually add a large trade, you could trigger a drawdown violation. The safest approach is letting the bot run solo on accounts meant for challenges and funded trading.

Is there any difference between MT4 and MT5 versions of the EA?

Both versions are functionally identical, but MT5 offers better backtesting speed, more asset support, and generally faster execution. MT4 remains popular because many prop firms still support it. If you’re choosing for the first time, we suggest MT5 since it is more future-proof. Whichever platform you choose, the ea to pass prop firm challenge is fully optimized for both.

What happens if my internet disconnects while the EA is running?

If your internet drops, open trades remain active on the broker’s server, but no new trades will be executed until your terminal reconnects. That’s why we recommend running the EA on a VPS with 99.9% uptime. A reliable VPS ensures the bot is always online, reducing the risk of missed trades or execution delays. It’s a small investment that makes a huge difference in stability.

Does your EA use dangerous martingale or grid strategies?

No. Our prop firm EA avoids dangerous martingale or grid systems. Those strategies can generate fast profits but almost always end in large losses, which directly violates prop firm rules. Instead, our EA uses risk-based trade sizing and a mix of momentum + mean-reversion entries. This approach ensures compliance with max loss limits while maintaining steady growth.

How do I maximize payouts once I get funded?

Once you pass a challenge, the goal is consistency. The EA continues running with the same strategy but now focuses on sustainable growth (8–16% monthly). The key is letting compounding work for you: instead of cashing out everything, withdraw part of profits and reinvest the rest. Many of our clients scale to multiple funded accounts this way, multiplying their payouts with the same strategy. In other words, the EA isn’t just an evaluation tool, it’s a long-term prop firm trading partner.

Do you offer training or community support along with the EA?

Yes. We provide a private Telegram group where funded traders share results, set files, and tweaks. You also receive written guides, video tutorials, and one-on-one support if needed. This community aspect is crucial, it gives you insights from traders who are already funded and actively using the EA. By learning from their setups, you speed up your own path to success.

Can your EA handle different broker conditions like high spreads or slippage?

Yes. Our prop firm expert advisor includes spread filters and slippage protection. It will not enter a trade if spreads are above a safe threshold. Additionally, the EA adapts lot size in real-time based on account leverage and liquidity. This ensures performance remains stable across different brokers, even if conditions aren’t ideal.

How does the refund guarantee work?

We offer a 30-day risk-free guarantee. If you install the EA, use the recommended settings, and still fail to pass due to the EA’s performance (not user error), you can request a refund. Our goal is not just to sell software but to actually help traders succeed. That’s why we’re confident enough to stand behind the results.